30 years ago the U.S. Small Business Administration (SBA) embarked on a journey

to support microlending in America by providing loan capital and grants to nonprofit

financial institutions throughout the country.

Total Loaned since 1992

Number of Microloans made

since 1992

Loaned to Minority Entrepreneurs

Microlenders are on the front lines of saving small business in America. The patient, flexible capital and technical assistance offered by microloan intermediaries is more important the ever in the current economic and COVID-19 health crisis. Intermediaries are an effective way of delivering not only capital, but the technical assistance and business evaluation many entrepreneurs will need both now and during economic recovery. More resources are needed to ensure very small businesses that have the tightest margins of small businesses can quickly access capital and avoid predatory lending.

The SBA Microloan program was authorized in 1991 (P.L. 102-140) to provide technical assistance and small-scale loans to small businesses that are unable to qualify for conventional loans and other SBA guaranteed loans. Working through a network of community based intermediary lenders, the SBA Microloan program is able to finance and support new, early stage, and existing businesses in underserved markets in rural and urban areas. The program has been successful in helping women, minorities, low-income, and veteran entrepreneurs turn their dreams into successful ventures that create jobs and grow the economy.

The Microloan Program provides loans to nonprofit intermediary lenders that subsequently lend funds, in amounts of $50,000 or less, to small businesses and startups. Microloan Intermediary lenders also receive grants of up to 25 percent of their SBA loan balance to help offset their cost of providing business-based training and technical assistance to micro-borrowers. The combination of capital, technical assistance, and training helps shore up the capacity of the micro-borrowers to turn a profit, improve operations, grow businesses, and support job creation and retention.

Access to capital is critical to the long-term success of small businesses. While the official SBA definition of a small business is a company with fewer than 500 employees, more than 80 percent of all businesses in this country employ 10 or fewer employees. The Microloan program is especially helpful to these smaller businesses because it allows intermediary lenders to provide small loans of up to $50,000 with fixed rates and tailored to their individual business needs.

The Microloan technical assistance program also provides participating intermediary lenders with matching grants for intensive marketing, management, and technical assistance to micro borrowers. These lenders are a “one-stop shop” where small businesses can secure flexible financing as well as individualized technical assistance as needed during the life of a loan. The fusion of loans and ongoing technical assistance is the linchpin of the program’s success.

Despite intermediaries serving “at risk” small businesses, SBA’s Microloan program has an exceptionally low historic loss rate of less than 2 percent.

The Microloan program has been an essential financing mechanism for women and minority entrepreneurs. A 2017 Senate Small Business Committee minority staff report, “Tackling the Gender Gap,” noted that women receive just 16 percent of all conventional small business loans and only 4.4 percent of the total dollar amount. Increasing access to SBA Microloans and making the terms more flexible are key to addressing the funding gap for women entrepreneurs. Similarly, a 2018 SBA Office of Advocacy report found that 73 percent of black small business owners rely on their own funds to finance their businesses compared to 43 percent of white small business owners.

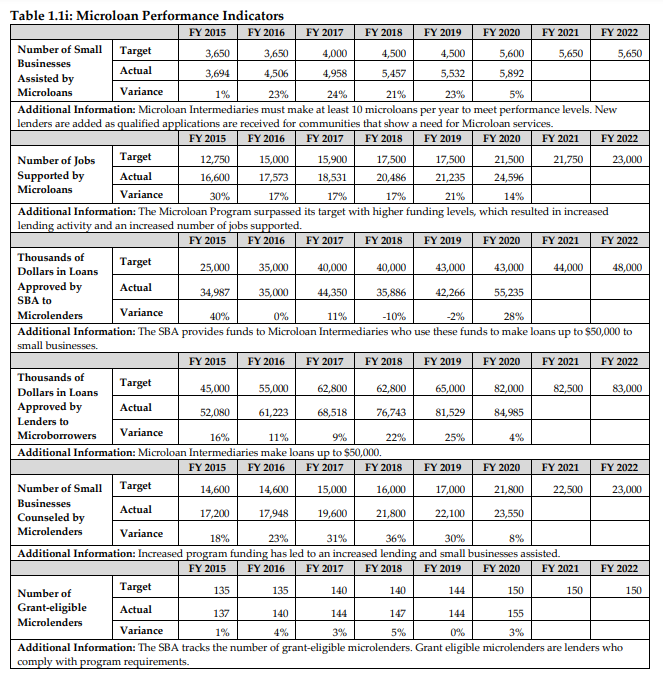

SBA Microloan FY 2020 Annual Performance Report

Learn About the SBA Microloan Program

SBA provides funds to specially designated intermediary lenders, which are nonprofit community-based organizations with experience in lending as well as management and technical assistance. These intermediaries administer the Microloan program for eligible borrowers.