The Friends Network supports economic opportunity for underserved entrepreneurs in rural, suburban, and urban communities across the nation by increasing access to the resources and services necessary to create wealth and build assets through business ownership. We also advocate for appropriations for the programs that support microlending at the Small Business Administration.

- FY 23 Budget

- FY 22 Budget

- Recent Changes to the Program

- Extend Expiring

Program Elements - Approve H.R.1502

FY 22 Appropriations

BUDGET OVERVIEW & PRESIDENT BIDEN

For the Small Business Administration, President Biden’s 2022 discretionary request includes $852 million for the SBA, a $74 million and 9.4% increase from the 2021 enacted level.

The discretionary request provides a $31 million increase over the 2021 enacted level for SBA Entrepreneurial Development Programs (EDP) that support women, people of color, and other underserved entrepreneurs.

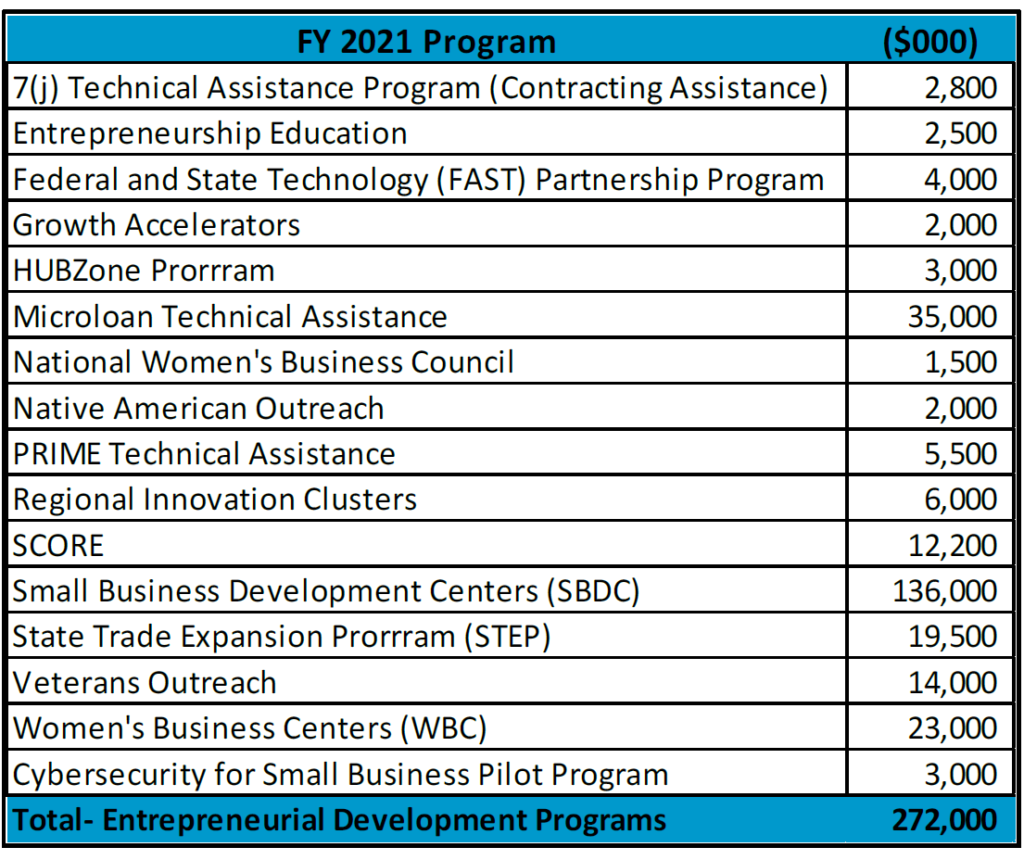

As a point of reference, last year’s adopted FY 2021 federal budget for the SBA Entrepreneurial Development program totaled $272 million, broken out in the enclosed table.

HOUSE: FINANCIAL SERVICES AND GENERAL GOVERNMENT APPROPRIATIONS BILL

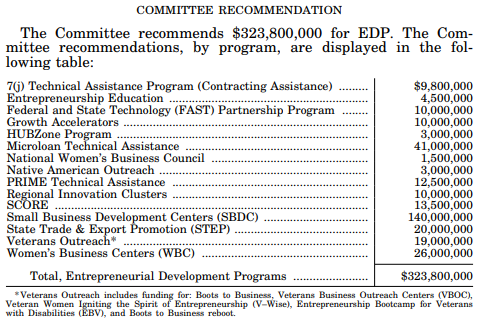

The ongoing House Appropriations FY2022 budgeting process has recommended an increase above President Biden’s budget for the EDP to $323.8 million , with the House Financial Services Committee recommending the Microloan program to receive $6 million more in funding than was approved last year, with $41 million in Technical Assistance funds, a nearly 15% program budget increase.

As of September 28th, 2021 the House of Representatives has not yet voted passage of their budget.

SENATE: FINANCIAL SERVICES AND GENERAL GOVERNMENT APPROPRIATIONS BILL

The Senate has not yet taken up a markup of Appropriations requests, as the House of Representatives as a whole has yet to vote on their Appropriations bill.

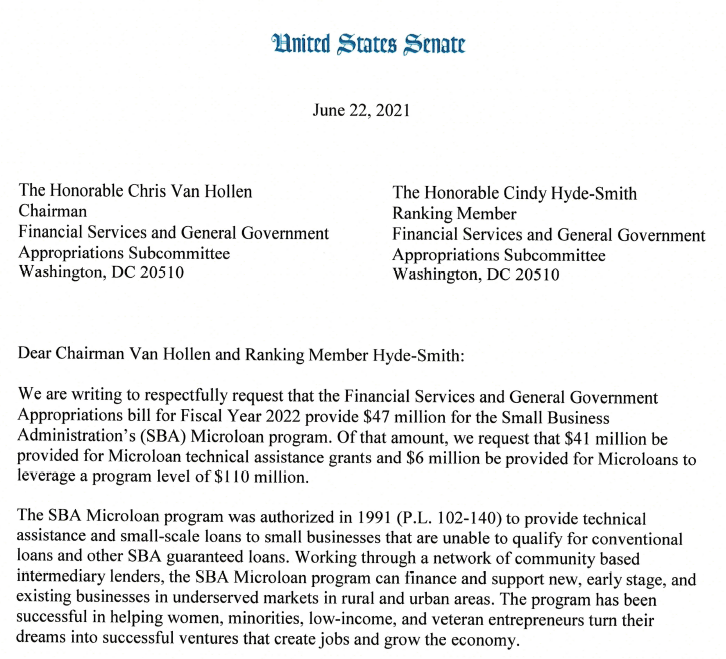

In June of 2021, the Friends group urged members of the Senate to join a “Dear Colleague” letter, addressed to the chairman and ranking member of the Senate Financial Services Committee.

The 28 Senators that signed the letter advocated for a total of $47 million to be appropriated to the Microloan program, with $41 million in technical assistance grants and $6 million in microloans, to leverage a program level of $110 million.

The Consolidated Appropriations Act enacted in December, 2020 made a number of temporary changes to the Microloan program, which expire at the end of Fiscal Year 2021. The legislation also include permanent changes that take effect on October 1, 2021.

Temporary FY21 Changes Expiring 9/30/21:

- Maximum of outstanding loan to an intermediary $10 million

- Maximum loan to an intermediary: $4.5 million

- Waiver of grant matching requirement for FY 20 grants (1/1/21-6/30/21) & FY 21 grants (7/1/21-9/30/21)

- Waiver of 50% limit on Technical Assistance grant expenses for marketing prospective borrowers and 3rd party contracts; Maximum loan term: 8 years for loans made 12/27/20-9/30/21.

Changes Scheduled to Take Effect 10/1/21:

- Maximum of outstanding loan to an intermediary: $7 million

- Maximum loan to an intermediary: $3 million

- Maximum loan term: 7 years

- Expanded eligibility for bonus grants; bonus equal to 5% of total outstanding SBA loan balance – 25% of loans businesses located in or owned by a resident of an economically distress area or 25% of microloan portfolio is in rural area; FY 21 bonus grants based on portfolios averaging up to $10,000

- New grant minimum- 25%; maximum 30% of Intermediary’s total outstanding loan balance. All intermediaries to receive 30% for FY 21

Friends Legislative Goal: Extend certain expiring provisions from the Consolidated Appropriations Act

Extend the $10 million loan limit to intermediaries through FY 23

- The provision in current law allowing a maximum outstanding loan of $10 million to an intermediary was enacted in the December Consolidated Appropriations Act and will expire less than 10 months later at the end of the FY 21. This has not allowed time for any intermediary to receive that level of maximum. Providing a longer time frame will allow intermediaries with demand and track record of performance will have a better opportunity to borrow additional microloan capital.

Make permanent the waiver of 50% limit on TA pre-loan and post-loan grant expenses for prospective borrowers

- This provision received a lot of feedback from the Friends, and there is strong support to permanently get rid of the 50% limit. In the almost 30 years the SBA Microloan Program has been in existence, the program has grown to 150 active intermediary lenders that have made more than totaling $1.093 billion in loans to more than 85,500 small businesses across America. This activity has resulted in the creation of more than 123,000 jobs created by the businesses that have received financing through this program and has supported more than 190,000 retained employees. The cumulative default rate on the microloan program is 1.8 percent.

- Intermediaries contend that the 50/50 limit is a burden and seems arbitrary, relative to the realities of needs regarding pre-loan and post-loan TA. Currently, every hour of Technical Assistance must be bucketed and tracked. While perhaps the original concept surrounding this provision was that the program administrators wanted to limit intermediaries from spending a maximum of the funds pre-loan, however, the program has proved successful, and the intermediaries feel they are in the strongest positions to decide what kind of TA is necessary for those seeking assistance. Underwriting a new borrower is a critical part of the microloan program. Reporting costs by quarter exacerbated the situation. SBA sets the interest rate, so intermediaries cannot raise interest rates to cover their costs.

- The provision in current law allowing a maximum outstanding loan of $10 million to an intermediary was enacted in the December Consolidated Appropriations Act and will expire less than 10 months later at the end of the FY 21. This has not allowed time for any intermediary to receive that level of maximum. Providing a longer time frame will allow intermediaries with demand and track record of performance will have a better opportunity to borrow additional microloan capital.

Friends Legislative Goal: Approve Measures from H.R. 1502

– Microloan Improvement Act of 2021 –

Re-introduced from legislation in previous sessions, H.R.1502 is legislation that the Friends have previously supported. The Microloan Improvement Act eliminates 1/55 in favor of setting aside 15% of appropriations for underserved areas for the first two quarters. The bill also authorizes use of micro loans for lines of credit and increases from $7500 to $10,000 loans eligible for a 7 year term and increases to 10 years the loan term for loans greater than $10,000.

- Adopt House provision eliminating the 1/55 rule in replacing with a reservation of 15% of appropriations for underserved lending during the first two quarters of the fiscal year, after which any unobligated funds are generally available.

- Adopt the House provision that changes the definition of small loans from $7,500 to $10,000. Intermediaries with loans averaging the small loan rate qualify for SBA microloans with an interest rate 2 percentage points below the Treasury rate.

- Adopt House provision authorizing the use of microloans for lines of credit.

- Adopt House provision eliminating the 1/55 rule in replacing with a reservation of 15% of appropriations for underserved lending during the first two quarters of the fiscal year, after which any unobligated funds are generally available.

- Adopt House provisions from HR 1502 that sets the maximum terms for loans up to $10,000 at 7 years and for loans over $10,000 of up to 10 years.